Insurance Choices For Individuals & Their Families

Get an instant quote and apply online for many of the products below.

Shop for health plans from leading providers.

Individual & Family Health Insurance

Also known as "Obamacare plans", this type of major medical insurance meets the ACA's minimum essential coverage requirements. These plans are eligible for lower premiums through government subsidies. See if you qualify.

Non-ACA Health Insurance

Also known as "short-term health insurance", non-ACA plans can be an affordable alternative for those who are in good health and don’t need coverage for maternity, mental health, substance abuse, or preexisting conditions. There is no designated enrollment period for these plans; you can apply at any time.

(Note: Non-ACA/short-term health insurance is medically underwritten and does not cover preexisting conditions. The coverage does not meet ACA minimum essential requirements.)

Stay competitive by offering health benefits to employees.

Easily control your business’s healthcare expenses while providing more personalized coverage options to your employees. From on-boarding to health insurance and everything in between, take care of all your benefits needs by creating your own custom benefits package.

Want to learn more?

A broad range of benefits for you and your employees.

Your custom package comes with a preinstalled voluntary ancillary benefits platform similar to what a Fortune 500 company offers their employees. Don't want to offer all of them? You can easily remove ancillary benefits at any time. You'll also have the ability to contribute funds to help your employees cover costs. It’s all up to you. Whatever works for your business, we'll make it easy. (Please note that availability of certain ancillary benefits will vary based on your SIC code.)

Coverage from leading benefits providers.

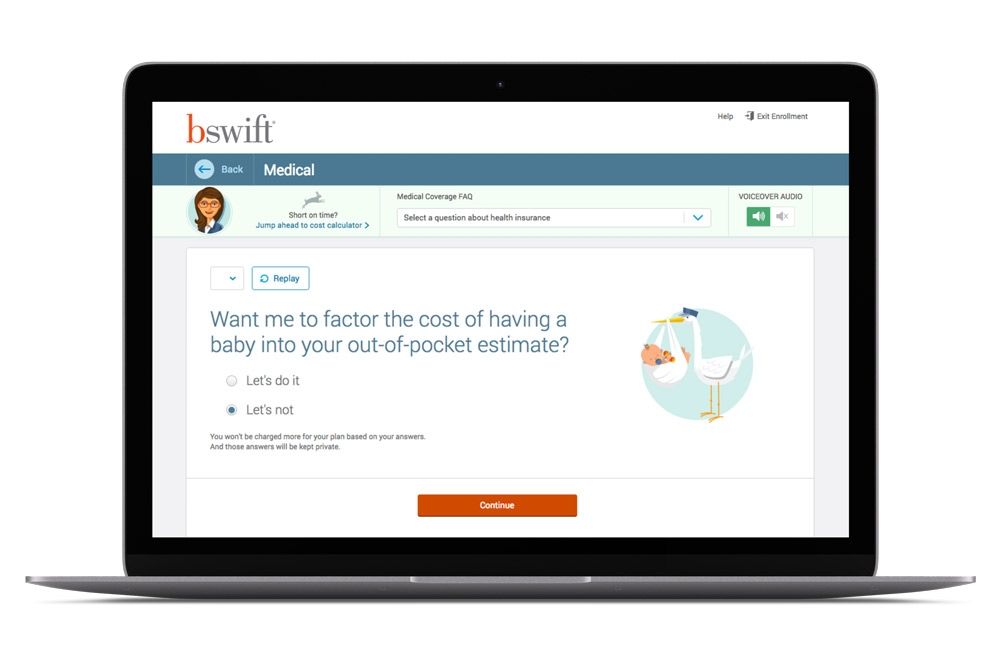

Complimentary industry-leading enrollment technology included.

Our enrollment technology solutions are designed to make it easy for you to manage employee benefits — and make it simple for your employees to find the options they need.

A decision support tool is built right into your platform. By answering a few short questions, employees can find the plan that best suits their needs. Other support features include a filtering tool, plan comparisons, and provider search tools.

If an employee still has questions they can use the live chat or call to get the advice of one of our experienced benefits counselors.

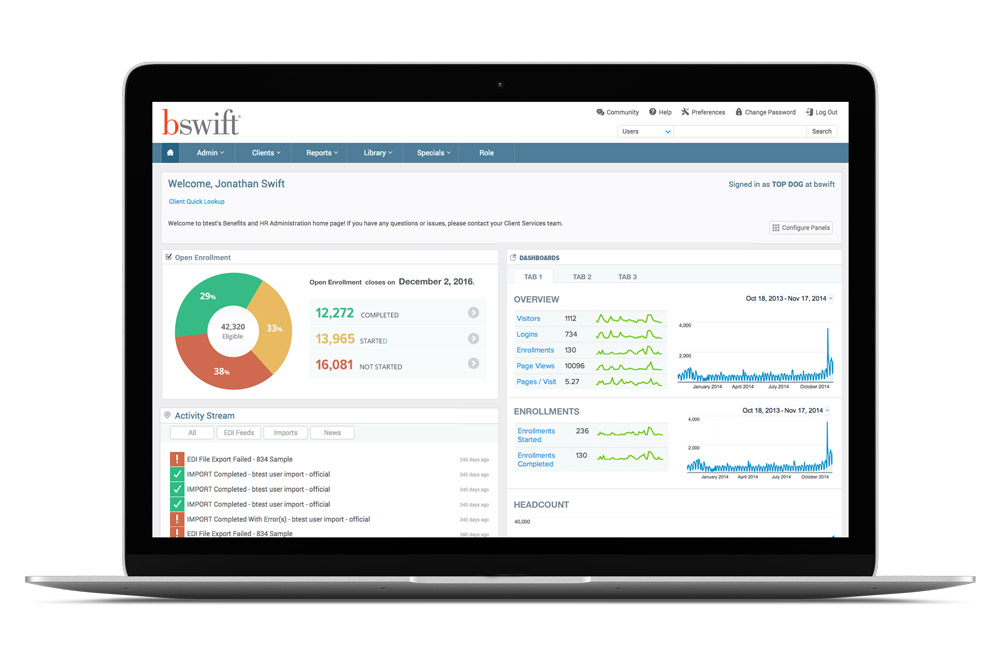

The HR Admin Portal is your source to manage your employees benefits. Once in the portal, you have access to real-time reporting tools that include almost any report you would ever need, and more!

Advanced billing features makes it easy for you to run monthly reports, apply retroactive adjustments, apply fees as appropriate, self bill, reconcile bills against carrier bills, and separate bills based on location, department, division or benefits status.

Make employees more aware of the investment you are dedicating to them with Total Compensation Statements. All enrollment information is already stored and the system can accept additional data such as payroll, 401(K) and more.

Special group rates for members, staff and dependents.

Choose from two MetLife PPO dental plans: one comes with the freedom to visit any licensed dentist, and the other allows you to save by visiting one of the thousands of participating dental locations nationwide, including specialists.1 Optional vision coverage can be added to either dental plan, and comes with coverage for exams, lenses, frames, contacts, and more.

Choose your plan and apply now.

• Lenses & frames

Helpful Dental Links

(coinsurance, copayments, deductibles, exclusions, and limitations)

(enter "PDP Plus" for network)

Helpful Vision Links

(coinsurance, copayments, deductibles, exclusions, and limitations)

(visit any provider, or save by using a participating MetLife provider)

1Savings from enrolling in the MetLife Dental Plan will depend on various factors, including how often participants visit the dentist and the costs for services rendered. Out-of-pocket costs may be greater if you visit a dentist who does not participate in the network.

2Rates are subject to geographic area and tier of coverage selected. Coverage may not be available in all states. Rates are subject to change.

This group plan is made available through the American Association of Business Networking (ABN). Membership in the ABN in required to enroll in this plan. You may enroll for membership in the ABN during your dental enrollment. Learn more about the ABN.

Group dental insurance policies featuring the Preferred Dentist Program are underwritten by Metropolitan Life Insurance Company, New York, NY 10166.

Vision plan may only be purchased in combination with a dental plan. Vision benefits are underwritten by Metropolitan Life Insurance Company, New York, NY (MetLife). Certain claim and network administration services are provided through Vision Service Plan (VSP), Rancho Cordova, CA. VSP is not affiliated with Metropolitan Life Insurance Company or its affiliates.

In some cases, the association and/or the plan administrator may incur costs in connection with providing oversight and administrative support for this sponsored plan. To provide and maintain this valuable membership benefit, MetLife reimburses the association and/or the plan administrator for these costs.

Like most group benefit programs, benefit programs offered by MetLife and its affiliates contain certain exclusions, exceptions, reductions, limitations, waiting periods and terms for keeping them in force. Please contact Member Benefits, the plan administrator at 1-800-282-8626 for costs and complete details.

Policy number 5343606

L0423031004[exp0425][All States][DC,GU,MP,PR,VI] © 2023 MetLife Services and Solutions, LLC

Group insurance coverage is issued by Metropolitan Life Insurance Company, New York, NY 10166.

Visiting a doctor just got a lot easier.

With an MDLIVE telehealth plan you can visit with a doctor 24/7 by phone, video, or app. It’s your anytime, anywhere doctor’s office. You'll have around-the-clock access to board-certified physicians and pediatricians—who can send prescriptions directly to your pharmacy, if medically necessary. Best of all: your family members can also use the service.

MDLIVE physicians treat more than 50 routine medical conditions, such as:

- Cold/Flu

- Allergies

- Cough

- Headache

- Sore throat

- Pink Eye

- Ear problems

- Nausea/Vomiting

- Sinus infection

- Acne

- Respiratory problems

- Urinary problems/UTI

Copyright © 2025 MDLIVE Inc. All Rights Reserved. MDLIVE is an independent company/entity and is not affiliated with Member Benefits. The services and website are provided exclusively by MDLIVE and not by Member Benefits. MDLIVE does not replace the primary care physician. MDLIVE operates subject to state regulation and may not be available in certain states. MDLIVE does not guarantee that a prescription will be written. MDLIVE does not prescribe DEA controlled substances, non-therapeutic drugs and certain other drugs which may be harmful because of their potential for abuse. MDLIVE physicians reserve the right to deny care for potential misuse of services. For complete terms of use visit www.mdlive.com/consumer/terms.html

Help secure your family's future.

Term Life Insurance can be a cost-effective way to help protect your family and finances in the event that something happens to you. By paying a benefit in the event of the death of the insured during a specified term, it can help ensure that short- and long-term financial obligations could be met. It’s important to take steps to make sure your family would be financially prepared if you were no longer there to handle expenses.

QuickTerm Life

(for coverage amounts up to $250,000)

This QuickTerm term life insurance plan, offered through MetLife, is a simplified way to apply for up to $250,000 in coverage depending on your age. You and your spouse/domestic partner may each apply for coverage, using our easy to use online short-form application. No medical exam is required as long as you meet the qualifications for this offer and can answer "No" to a few medical questions. If we find no further information is needed upon review of your application, then you’re done! It’s as easy as that1.

Online Application

Coverage Limits

under age 40: $50,000 - $250,000

age 40-49: $50,000 - $150,000

age 50-59: $50,000 - $100,000

(Need more coverage? Take a look at our Member Term Life plan.)

Plan Benefits

- Grief Counseling2: Access professional support in a time of need. Meet in-person or by phone with a licensed counselor to help cope with a loss or major life change.

- Will Preparation Services3: Helping to ensure your final wishes are clear. Get help preparing or updating a will, living will or power of attorney.

- Estate Resolution Services3: Settling an estate with confidence. With unlimited consultations, either in person with an attorney or by phone, including court representations.

- Accelerated Benefit Option4: Receive a percentage of your life insurance in the event that you become terminally ill and are diagnosed with no more than a specified amount of time to live.

- Funeral Planning Assistance2: Honoring a loved one’s life. Work with compassionate counselors that assist with customizing funeral arrangements with personalized one-on-one service.

- Total Control Account®5: Provides your loved ones with a safe and convenient way to manage life insurance proceeds.

- Dignity Memorial®6: Get access to the largest network of funeral homes and cemeteries to pre-plan with a counselor and receive discounts on funeral services.

How Much Do I Need?

It may be more than you have now. You should keep in mind that insurance may need to change as your life changes — for example, getting married, starting a family or purchasing a home. Many people are surprised to learn that they may not have enough life insurance to cover the many expenses their loved ones may face. We’ve made it very simple to help you determine the amount of coverage you may need now: Go to lifeonlinecalculator.com and click on the easy-to-use life insurance calculator to find your answer in minutes.

Special Offer

Accidental Death and Dismemberment Benefits (AD&D) are also available for a small additional cost when purchasing a MetLife term life plan. AD&D can help provide financial security should a sudden, covered accident take your life or cause you serious loss or harm. This coverage complements your life insurance coverage and can help protect you 24 hours a day, 365 days a year.

Underwritten by:

1. You must be performing your normal activities for coverage to become effective. If answers to medical questions are unfavorable, then full underwriting may be required and coverage is subject to approval of insurer.

2. Grief Counseling and Funeral Planning Assistance are provided through an agreement with LifeWorks US Inc. LifeWorks is not an affiliate of MetLife, and the services LifeWorks provides are separate and apart from the insurance provided by MetLife. LifeWorks has a nationwide network of over 30,000 counselors. Counselors have master’s or doctoral degrees and are licensed professionals. The Grief Counseling program does not provide support for issues such as: domestic issues, parenting issues, or marital/relationship issues (other than a finalized divorce). This program is available to insureds, their dependents and beneficiaries who have received a serious medical diagnosis or suffered a loss. Events that may result in a loss are not covered under this program unless and until such loss has occurred.

3. Will preparation and MetLife Estate Resolution Services are offered by MetLife Legal Plans, Inc., Cleveland, Ohio. In certain states, legal services benefits are provided through insurance coverage underwritten by Metropolitan Property and Casualty Insurance Company and affiliates, Warwick, Rhode Island. For New York-sitused cases, the will preparation service is an expanded offering that includes office consultations and telephone advice for certain other legal matters beyond will preparation. Tax planning and preparation of living trusts are not covered by the will preparation service. Certain services are not covered by estate resolution services, including matters in which there is a conflict of interest between the executor and any beneficiary or heir and the estate; any disputes with the group policyholder, MetLife and/or any of its affiliates; any disputes involving statutory benefits; will contests or litigation outside probate court; appeals; court costs, filing fees, recording fees, transcripts, witness fees, expenses to a third party, judgments or fines; and frivolous or unethical matters.

4. The Accelerated Benefits Option (ABO) is subject to state availability and regulation. The ABO benefits are intended to qualify for favorable federal tax treatment, in which case the benefits will not be subject to federal taxation. This information was written as a supplement to the marketing of life insurance products. Tax laws relating to accelerated benefits are complex and limitations may apply. You are advised to consult with and rely on an independent tax advisor about your own particular circumstances. Receipt of ABO benefits may affect your eligibility, or that of your spouse or your family, for public assistance programs such as medical assistance (Medicaid), Temporary Assistance to Needy Families (TANF), Supplementary Social Security Income (SSI) and drug assistance programs. You are advised to consult with social service agencies concerning the effect that receipt of ABO benefits will have on public assistance eligibility for you, your spouse or your family.

5. Subject to state law, and/or group policyholder direction, the Total Control Account is provided for all Life and AD&D benefits of $5,000 or more. The TCA is not insured by the Federal Deposit Insurance Corporation or any government agency. The assets backing TCA are maintained in MetLife’s general account and are subject to MetLife’s creditors. MetLife bears the investment risk of the assets backing the TCA and expects to earn income sufficient to pay interest to TCA Accountholders and to provide a profit on the operation of the TCAs.

6. Services and discounts are provided through a member of the Dignity Memorial® Network, a brand name used to identify a network of licensed funeral, cremation and cemetery providers that are affiliates of Service Corporation International (together with its affiliates, “SCI”), 1929 Allen Parkway, Houston, Texas. The online planning site is provided by SCI Shared Resources, LLC. SCI is not affiliated with MetLife, and the services provided by Dignity Memorial members are separate and apart from the insurance provided by MetLife. Not available in some states. SCI offers planning services, expert assistance, and bereavement travel services to anyone regardless of affiliation with MetLife. Discounts through Dignity Memorial’s network of funeral providers have been pre-negotiated. Not available where prohibited by law. If the group policy is issued in an approved state, the discount is available for funeral services held in any state except KY and NY, or where there is no Dignity Memorial presence (AK, MT, ND, SD, and WY). For TN, the funeral services discount is available for “At Need” services only. Not approved in AK, FL, KY, MT, ND, NY and WA.

Term Life coverage not available in AK, ME, NH, NM, OR, or UT. AD&D coverage not available in AK, MD, ME, NH, NM, OR, UT, or WA. Please contact Member Benefits at 1-800-282-8626 for more information.

This plan is made available to you through membership in the American Association of Business Networking (ABN). An ABN membership is required to enroll in this Term Life plan. You can join the ABN during your Term Life plan enrollment. Learn more about the ABN here.

Like most insurance policies, insurance policies offered by MetLife and its affiliates contain certain exclusions, exceptions, reductions, limitations, waiting periods and terms for keeping them in force. Please contact Member Benefits at 1-800-282-8626 for costs and complete details.

Download the MetLife Privacy Notice.

Metropolitan Life Insurance Company | 200 Park Avenue | New York, NY 10166

L0423031005[exp0425][All States][DC,GU,MP,PR,VI] © 2023 MetLife Services and Solutions, LLC

Help secure your family's future.

Term Life Insurance can be a cost-effective way to help protect your family and finances in the event that something happens to you. By paying a benefit in the event of the death of the insured during a specified term, it can help ensure that short- and long-term financial obligations could be met. It’s important to take steps to make sure your family would be financially prepared if you were no longer there to handle expenses.

Member Term Life

(for coverage amounts up to $1,000,000)

This fully underwritten group term life insurance plan is offered by MetLife. You and your spouse/domestic partner, depending on their age(s), may apply for coverage, using our long-form application. Apply for up to $1,000,000 in coverage. Rates increase in 5-year age bands.

When you apply, simply answer the health questions. Even if you have a health condition, you may still qualify. Depending on the amount applied for, a paramedical exam and blood test may be required, which will be scheduled at your convenience and at no cost to you.

Online Application

Coverage Limits

under age 59: $50,000 - $1,000,000

Plan Benefits

- Grief Counseling2: Access professional support in a time of need. Meet in-person or by phone with a licensed counselor to help cope with a loss or major life change.

- Will Preparation Services3: Helping to ensure your final wishes are clear. Get help preparing or updating a will, living will or power of attorney.

- Estate Resolution Services3: Settling an estate with confidence. With unlimited consultations, either in person with an attorney or by phone, including court representations.

- Accelerated Benefit Option4: Receive a percentage of your life insurance in the event that you become terminally ill and are diagnosed with no more than a specified amount of time to live.

- Funeral Planning Assistance2: Honoring a loved one’s life. Work with compassionate counselors that assist with customizing funeral arrangements with personalized one-on-one service.

- Total Control Account®5: Provides your loved ones with a safe and convenient way to manage life insurance proceeds.

- Dignity Memorial®6: Get access to the largest network of funeral homes and cemeteries to pre-plan with a counselor and receive discounts on funeral services.

How Much Do I Need?

It may be more than you have now. You should keep in mind that insurance may need to change as your life changes — for example, getting married, starting a family or purchasing a home. Many people are surprised to learn that they may not have enough life insurance to cover the many expenses their loved ones may face. We’ve made it very simple to help you determine the amount of coverage you may need now: Go to lifeonlinecalculator.com and click on the easy-to-use life insurance calculator to find your answer in minutes.

Special Offer

Accidental Death and Dismemberment Benefits (AD&D) are also available for a small additional cost when purchasing a MetLife term life plan. AD&D can help provide financial security should a sudden, covered accident take your life or cause you serious loss or harm. This coverage complements your life insurance coverage and can help protect you 24 hours a day, 365 days a year.

Underwritten by:

1. You must be performing your normal activities for coverage to become effective. If answers to medical questions are unfavorable, then full underwriting may be required and coverage is subject to approval of insurer.

2. Grief Counseling and Funeral Planning Assistance are provided through an agreement with LifeWorks US Inc. LifeWorks is not an affiliate of MetLife, and the services LifeWorks provides are separate and apart from the insurance provided by MetLife. LifeWorks has a nationwide network of over 30,000 counselors. Counselors have master’s or doctoral degrees and are licensed professionals. The Grief Counseling program does not provide support for issues such as: domestic issues, parenting issues, or marital/relationship issues (other than a finalized divorce). This program is available to insureds, their dependents and beneficiaries who have received a serious medical diagnosis or suffered a loss. Events that may result in a loss are not covered under this program unless and until such loss has occurred.

3. Will preparation and MetLife Estate Resolution Services are offered by MetLife Legal Plans, Inc., Cleveland, Ohio. In certain states, legal services benefits are provided through insurance coverage underwritten by Metropolitan Property and Casualty Insurance Company and affiliates, Warwick, Rhode Island. For New York-sitused cases, the will preparation service is an expanded offering that includes office consultations and telephone advice for certain other legal matters beyond will preparation. Tax planning and preparation of living trusts are not covered by the will preparation service. Certain services are not covered by estate resolution services, including matters in which there is a conflict of interest between the executor and any beneficiary or heir and the estate; any disputes with the group policyholder, MetLife and/or any of its affiliates; any disputes involving statutory benefits; will contests or litigation outside probate court; appeals; court costs, filing fees, recording fees, transcripts, witness fees, expenses to a third party, judgments or fines; and frivolous or unethical matters.

4. The Accelerated Benefits Option (ABO) is subject to state availability and regulation. The ABO benefits are intended to qualify for favorable federal tax treatment, in which case the benefits will not be subject to federal taxation. This information was written as a supplement to the marketing of life insurance products. Tax laws relating to accelerated benefits are complex and limitations may apply. You are advised to consult with and rely on an independent tax advisor about your own particular circumstances. Receipt of ABO benefits may affect your eligibility, or that of your spouse or your family, for public assistance programs such as medical assistance (Medicaid), Temporary Assistance to Needy Families (TANF), Supplementary Social Security Income (SSI) and drug assistance programs. You are advised to consult with social service agencies concerning the effect that receipt of ABO benefits will have on public assistance eligibility for you, your spouse or your family.

5. Subject to state law, and/or group policyholder direction, the Total Control Account is provided for all Life and AD&D benefits of $5,000 or more. The TCA is not insured by the Federal Deposit Insurance Corporation or any government agency. The assets backing TCA are maintained in MetLife’s general account and are subject to MetLife’s creditors. MetLife bears the investment risk of the assets backing the TCA and expects to earn income sufficient to pay interest to TCA Accountholders and to provide a profit on the operation of the TCAs.

6. Services and discounts are provided through a member of the Dignity Memorial® Network, a brand name used to identify a network of licensed funeral, cremation and cemetery providers that are affiliates of Service Corporation International (together with its affiliates, “SCI”), 1929 Allen Parkway, Houston, Texas. The online planning site is provided by SCI Shared Resources, LLC. SCI is not affiliated with MetLife, and the services provided by Dignity Memorial members are separate and apart from the insurance provided by MetLife. Not available in some states. SCI offers planning services, expert assistance, and bereavement travel services to anyone regardless of affiliation with MetLife. Discounts through Dignity Memorial’s network of funeral providers have been pre-negotiated. Not available where prohibited by law. If the group policy is issued in an approved state, the discount is available for funeral services held in any state except KY and NY, or where there is no Dignity Memorial presence (AK, MT, ND, SD, and WY). For TN, the funeral services discount is available for “At Need” services only. Not approved in AK, FL, KY, MT, ND, NY and WA.

Term Life coverage not available in AK, ME, NH, NM, OR, or UT. AD&D coverage not available in AK, MD, ME, NH, NM, OR, UT, or WA. Please contact Member Benefits at 1-800-282-8626 for more information.

This plan is made available to you through membership in the American Association of Business Networking (ABN). An ABN membership is required to enroll in this Term Life plan. You can join the ABN during your Term Life plan enrollment. Learn more about the ABN here.

Like most insurance policies, insurance policies offered by MetLife and its affiliates contain certain exclusions, exceptions, reductions, limitations, waiting periods and terms for keeping them in force. Please contact Member Benefits at 1-800-282-8626 for costs and complete details.

Download the MetLife Privacy Notice.

Metropolitan Life Insurance Company | 200 Park Avenue | New York, NY 10166

L0423031005[exp0425][All States][DC,GU,MP,PR,VI] © 2023 MetLife Services and Solutions, LLC

Help secure your family's future.

Term Life Insurance can be a cost-effective way to help protect your family and finances in the event that something happens to you. By paying a benefit in the event of the death of the insured during a specified term, it can help ensure that short- and long-term financial obligations could be met. It’s important to take steps to make sure your family would be financially prepared if you were no longer there to handle expenses.

Individual Term Life

(for coverage amounts up to $10,000,000)

Individual term life insurance is offered through leading insurance carriers. Because there is a limited period of coverage, premiums are often considerably lower than permanent life insurance. When you apply, simply answer the health questions. Even if you have a health condition, you may still qualify. Depending on the amount applied for, a paramedical exam and blood test may be required, which will be scheduled at your convenience and at no cost to you.

Online Application

Coverage Limits

age 18-69: $50,000 – $10,000,000

age 70-80: $100,000 – $10,000,000

Plan Benefits

- Available to you, your spouse/domestic partner, and other family members between the ages of 18-70.

- Benefit period options: 10, 15, 20, and 30 year periods where premiums will not increase as you age.

- Options to waive medical exam requirements.

- Support when you need or want it: to help you understand life insurance, compare life insurance quotes, and make the right decision for your family.

Benefits that help cover the health insurance gaps when faced with serious illnesses.

The financial impact of major health conditions such as cancer, heart attack, and stroke can create hardships for most Americans and their families. Critical Illness (CI) insurance provides additional financial protection for serious illnesses such as cancer, heart attack, stroke, Alzheimer’s Disease, renal failure, and more.

Members under age 65 can get up to $30,000 of CI coverage on a guaranteed issue basis, and eligible spouses of members can get up to $15,000 of coverage on a guaranteed issue basis. (Additional amounts of coverage require evidence of insurability.) This valuable insurance coverage is provided by The Prudential Insurance Company of America.

Ready to enroll for Critical Illness Insurance?

Premiums vary based on age. (Example: The monthly premium for $30,000 of CI insurance for a 40-year-old member is around $16/mo.) Benefits paid under this CI policy are in addition to any other benefits you may receive, and are paid directly to you.

Flexible Coverage Amounts

Members who are 64 years old or younger may enroll for up to $30,000 of coverage, in $10,000 increments, allowing you to select the right level of insurance protection for yourself. At age 70, your coverage amount reduces to 50% of the initial coverage amount.

A Spouse/Domestic Partner (DP) may enroll for coverage up to $15,000 and children up to $15,000, in $5,000 increments. Neither the Spouse/Domestic Partner or children can exceed 50% of the member benefit.

No Restrictions On How You Use Your Benefit Payment

Even with health insurance, out-of-pocket medical and non-medical expenses such as deductibles or co-pays can really cause financial strain. With Critical Illness insurance, there are no limitations in how you use your benefit payments. The money can be used for anything you choose, such as home care and treatment, recuperation aid, mortgage payments or rent, child care, over-the-counter medications, groceries, college tuition, or travel to a treatment center.

Benefits are payable directly to you, as per the terms of the policy.

Does Not Terminate After One Benefit Payment

A reoccurrence benefit is a part of our standard offering and allows an insured to receive additional benefit payments for the second diagnosis of a previously covered condition up to a maximum benefit amount. The reoccurence benefit is payable at 100% of the amount paid for the first occurrence of the critical illness.

Coverage of These Ten Conditions

100% of the Amount of Insurance Payable For:

- Invasive Cancer

- Heart Attack

- Major Organ Failure

- Stroke

- Renal Failure

- Alzheimer's Disease

25% of the Amount of Insurance Payable For:

- Cancer in Situ

- Severe Coronary Artery Disease

- Severe Heart Valve Malfunction

- Coma

The Lifetime Maximum Benefit is 200% of your amount of Insurance.

Additional Benefits

National Cancer Institute (NCI) Evaluation Benefit Amount Payable

- $500; plus

- $250 for the transportation and lodging of the Covered Person requiring the evaluation if the NCI facility is more than 100 miles from the Covered Person’s primary residence.

Transportation Benefit Amount Payable

- The actual charges insured for travel by train, plane or bus

- Noncommercial travel of $0.50 per mile for travel by personal car

- Up to annual maximum of $1,000 per calendar year

- Excludes hospitals or medical facilities within 50 miles one way, from coverage person’s primary residence.

Lodging Benefit Amount Payable

- $100 per day for up to 60 days per calendar year per covered person receiving treatment

- Excludes hospitals or medical facilities within 50 miles one way, from the covered person’s primary residence. Not payable for lodging occurring more than 24 hours prior to treatment nor for lodging occurring more than 24 hours following treatment.

Lodging Benefit Annual Limit

- The Lodging Benefit is limited to 60 days per calendar year for each Covered Person receiving treatment during that visit.

Quick Payout Process to Policyholder

A lump sum is paid to the policyholder if he or she is diagnosed with a specific illness stated on an insurance company’s predetermined list.

SEE THE CERTIFICATE OF INSURANCE FOR DETAILED PLAN COVERAGE, EXCLUSIONS, AND LIMITATIONS. THE MEMBER CRITICAL ILLNESS INSURANCE IS SPONSORED BY THE AMERICAN ASSOCIATION OF BUSINESS NETWORKING (ABN) AND OFFERED ONLY TO MEMBERS. Learn more about ABN.

The products issued by The Prudential Insurance Company of America may not be available in all states.

This coverage is not health insurance coverage (often referred to as “Major Medical Coverage”).

This type of plan is NOT considered “minimum essential coverage” under the Affordable Care Act and therefore does NOT satisfy the individual mandate that you have health insurance coverage.

Group Critical Illness Insurance coverage is a limited benefit policy issued by The Prudential Insurance Company of America, a Prudential Financial company, Newark, NJ. Prudential’s Critical Illness Insurance is not a substitute for medical coverage that provides benefits for medical treatment, including hospital, surgical, and medical expenses, and it does not provide reimbursement for such expenses. The Booklet-Certificate contains all details, including any policy exclusions, limitations, and restrictions, which may apply. If there is a discrepancy between this document and the Booklet-Certificate/Group Contract issued by The Prudential Insurance Company of America, the Group Contract will govern. A more detailed description of the benefits, limitations, and exclusions applicable are contained in the Outline of Coverage provided at time of enrollment. Please contact Prudential for more information. Contract provisions may vary by state. Contract Series:114774. CA COA #1179, NAIC #68241.

1055694-00001-00

Get the protection you and your family need.

Looking for affordable insurance protection that goes beyond your primary medical, long-term disability, and life insurance coverage? Consider the AD&D Plan issued by The Prudential Insurance Company of America. It’s AD&D coverage for specific injuries outlined in the schedule of benefits below.

As part of your membership, members under the age of 65 are eligible to apply for $500,000 of AD&D coverage. Acceptance is guaranteed—there are no medical exams or questions. To request coverage, simply sign up using the online web request form.

Ready to enroll for AD&D Insurance?

AD&D Options

Insure yourself as well as your dependents with Accidental Death & Dismemberment (AD&D) Insurance. AD&D provides benefits for losses caused by accidental bodily injury.

Members can add $250,000 coverage on their spouse, and eligible dependent children can be covered for $10,000 per child. (A newborn child is not your qualified dependent until the first premium due date following birth.)

Who Is Eligible To Apply?

Members:

Members who are less than age of 65 may apply for $500,000 of AD&D coverage.

Eligible Dependents:

Spouse/domestic partner and dependent children less than 26 years old. Your children include your legally adopted children, step-children and foster children who depend upon you for support and maintenance.

AD&D Schedule of Benefits

| Basic AD&D | Optional AD&D | |

| LOSS OF: | % of PRINCIPAL SUM | % of PRINCIPAL SUM |

| Life | 100% | 100% |

| Both Hands or Both Feet | 100% | 100% |

| Sight in Both Eyes | 100% | 100% |

| One Hand and Foot | 100% | 100% |

| One Hand or One Foot and Sight of One Eye | 100% | 100% |

| One Hand or One Foot | 50% | 50% |

| Sight of One Eye | 50% | 50% |

| Speech | 50% | 50% |

| Hearing in Both Ears | 50% | 50% |

| Speech & Hearing in Both Ears | 100% | 100% |

| Four Fingers of the Same Hand | 25% | 25% |

| Thumb & Index Finger of Same Hand | 25% | 25% |

| Hearing in One Ear | 25% | 25% |

| Uniplegia | 25% | 25% |

| Quadriplegia | 100% | 100% |

| Paraplegia | 75% | 75% |

| One Arm or One Leg | 75% | 75% |

| Hemiplegia | 50% | 50% |

| Triplegia | 75% | 75% |

| All Toes on One Foot | 13% | 13% |

| Big Toe | 5% | 5% |

| Loss of Use* of One Hand or One Foot / or One Arm / or One Leg | 25% | 25% |

| Coma | lesser of 2% per month and $1,000, up to 100 months | lesser of 2% per month and $1,000, up to 100 months |

| Exposure and Disappearance Benefit** | % of Principal sum consistent with type of loss | % of Principal sum consistent with type of loss |

| Additional Benefits for Loss of Life due to: | ||

| Seat Belt (If it cannot be determined that the person was wearing a Seat Belt at the time of the Accident, a benefit of $1,000 will be paid.) | Additional 10% up to $25,000 | Additional 10% up to $25,000 |

| Airbag | Additional 10% up to $10,000 | Additional 10% up to $10,000 |

Additional Benefits are included in the coverage and are as follows:

- Bereavement and Trauma Counseling Benefit

- Child Care Expense Benefit

- Child Tuition Reimbursement Benefit

- Hearing Aids and Prosthetic Devices Benefit

- Home Alteration and Vehicle Modification Benefit

- Monthly Mortgage Payment Benefit

- Monthly Rehabilitation Expense Benefit

- Return of Remains Benefit

- Spouse Tuition Reimbursement Benefit

- Surgical Replantation Benefit

See certificate for benefit details.

*Loss of Use: The total and permanent loss of function.

**For the purposes of the Coverage:

(1) Exposure to the Elements will be considered an accidental bodily Injury. Exposure to the Elements means exposure to severe hot or cold weather that results in actual significant physical injury including sun stroke, heat stroke and frostbite.

(2) It will be presumed that the person has suffered a Loss of life if the person's body has not been found within one year of disappearance, stranding, sinking or wrecking of any vehicle in which the person was an occupant.

NY Residents: This policy provides ACCIDENT insurance only. It does NOT provide basic hospital, basic medical or major medical insurance as defined by the New York Department of Financial Services.

IMPORTANT NOTICE: THIS POLICY DOES NOT PROVIDE COVERAGE FOR SICKNESS.

This site may contain marketing language, on products issued by The Prudential Insurance Company of America, that has not yet been approved in all states.

The products issued by The Prudential Insurance Company of America may not be available in all states.

This is not a complete description of the plan, but merely a brief summary. For additional information including benefits, limitations and exclusions contact the administrator, Member Benefits, for a brochure. After you enroll, you will be issued a Group Insurance Certificate describing your coverage in greater detail. The complete terms of the coverage will be governed by the group insurance contract issued by the carrier.

Accidental Death & Dismemberment Insurance coverage is issued by The Prudential Insurance Company of America, a Prudential Financial company, Newark, NJ. The Booklet-Certificate contains all details, including any policy exclusions, limitations, and restrictions, which may apply. Contract Series 83500. CA COA #1179, NAIC #68241

1055694-00001-00

The coverage you need. The answers you want.

Whether you’re turning 65, already on Medicare, or helping a family member with their decision, getting solid advice is vital. Is a Medicare Advantage Plan or a Medicare Supplement Plan right for you? What about prescription drug coverage? We can help you sort through the many confusing Medicare options to make the best decision for your specific circumstances.

Residents of FL / GA / TX:

Residents of all other states:

Please call 1-833-852-6353 to be connected with a HealthSherpa Medicare agent. (M-F, 9a-8p ET)

Protect today. Thrive tomorrow.

Each year, tens of millions of Americans fall victim to identity theft. Restoring your identity and credit can be a lengthy, costly, and confusing process. Allstate Identity ProtectionSM helps safeguard your finances, reputation, and credit against theft and abuse.

Allstate Identity Protection is the most advanced identity protection available on the market today. Features of this industry-leading platform include:

- Enhanced Identity Monitoring

- Dark Web Monitoring

- Financial Activity Monitoring

- Social Media Monitoring

- Credit Monitoring

- Lost Wallet Protection

- Solicitation Reduction

- $1,000,000 identity theft insurance†

- Data Breach Notifications

- Full-service Remediation & Case Management

- And much more

Special member pricing on Allstate Identity Protection Pro Plus.

†Identity theft insurance covering expense and stolen funds reimbursement is underwritten by American Bankers Insurance Company of Florida, an Assurant company.

The description herein is a summary and intended for informational purposes only and does not include all terms, conditions and exclusions of the policies described. Please refer to the actual policies for terms, conditions, and exclusions of coverage. Coverage may not be available in all jurisdictions.

Allstate Identity Protection is offered and serviced by InfoArmor, Inc., a subsidiary of The Allstate Corporation. InfoArmor is an independent company/entity and is not affiliated with Member Benefits. The services and website are provided exclusively by InfoArmor and not by Member Benefits. Copyright © 2025 InfoArmor, Inc. All rights reserved.

Protection for your four-legged friends.

Pet insurance reimburses you for covered vet bills when your pet is sick or hurt. You can also get optional coverage for wellness and preventive care like shots and flea medicine.

Metlife Pet Insurance offers affordable, award-winning1 coverage with:

- 5% affinity group discount2

- 10% discount for serving Military, Veteran, 1st Responder and Healthcare Workers2

- Up to 90% of your vet bills reimbursed3

- Freedom to visit any U.S. veterinarian

- Cover multiple pets on one policy4

- Preventive Care coverage (optional) for routine wellness

- 24/7 access to Telehealth Concierge Services5 for immediate assistance

- Accident coverage and optional Preventive Care coverage begin on the effective date of your policy; illness coverage begins 14 days later.6

What's covered:

- Accidental injuries

- Illnesses

- Exam fees

- Surgeries

- Medications

- Ultrasounds

- Hospital stays

- X-rays and diagnostic tests

- ...and much more

1 “2024 Pet Insurance of the Year Award” Winners, Pet Independent Innovation Awards

2 Must be eligible for applicable discount. When using multiple discounts, discounts cannot exceed 30%. Each discount may not be available in all states. Please contact MetLife Pet for further details.

3 Reimbursement options include 50%, 70%, 80% and 90%. Pet age restrictions may apply.

4 Family plan policies are limited to dogs age 12 and under and cats age 14 and under. Multi-policy discount is not available with Family Plans.

5 Virtual veterinary services are available through the MetLife Pet app and are provided entirely by AskVet, a third-party partner; MetLife is not responsible for any pet guidance or advice provided or taken. Veterinarians providing virtual veterinary services cannot prescribe medication or answer questions about the pet policy.

6 Accident coverage begins on midnight EST of the effective day of your policy compared to a wait time of 2 to 15 days for many competitors; Illness coverage begins 14 days from the effective day of your policy compared to 14 to 30 days for many competitors.

Pet Insurance coverage issued by Metropolitan General Insurance Company, a Rhode Island insurance company headquartered at 700 Quaker Lane, Warwick, RI 02886. Coverage subject to restrictions, exclusions and limitations and application is subject to underwriting. See policy or contact MetLife Pet Insurance Solutions LLC (“MetLife Pet”) for details. MetLife Pet is the policy administrator. It may operate under an alternate or fictitious name in certain jurisdictions, including MetLife Pet Insurance Services LLC (New York and Minnesota) and MetLife Pet Insurance Solutions Agency LLC (Illinois).

L0325047093[exp0326][All States][PR] © 2025 MetLife Services and Solutions, LLC, New York, NY 10166. All Rights Reserved.

© 2025 Peanuts Worldwide LLC

Exclusive travel discounts on hotels, car rentals, and entertainment.

Save time and money when booking your next trip and let us compare pricing for you. Enjoy exclusive discounts that average 10%-20% savings below market on all hotels, car rentals, and entertainment tickets around the world – and comes with a low-rate guarantee.

Have a question or need help enrolling?

Our licensed benefits counselors are here to help. Call us at 1-800-282-8626, or make an online appointment:

Copyright © 2025 Member Benefits Inc. All rights reserved. Terms of Use | Privacy Policy