Insurance Choices For Members & Their Families

Get an instant quote and apply online for many of the products below.

Shop for health plans from leading providers.

Individual & Family Health Insurance

Also known as "Obamacare plans", this type of major medical insurance meets the ACA's minimum essential coverage requirements. These plans are eligible for lower premiums through government subsidies. See if you qualify.

Non-ACA Health Insurance

Also known as "short-term health insurance", non-ACA plans can be an affordable alternative for those who are in good health and don’t need coverage for maternity, mental health, substance abuse, or preexisting conditions. There is no designated enrollment period for these plans; you can apply at any time.

(Note: Non-ACA/short-term health insurance is medically underwritten and does not cover preexisting conditions. The coverage does not meet ACA minimum essential requirements.)

Stay competitive by offering health benefits to employees.

Easily control your business’s healthcare expenses while providing more personalized coverage options to your employees. From on-boarding to health insurance and everything in between, take care of all your benefits needs by creating your own custom benefits package.

Want to learn more?

A broad range of benefits for you and your employees.

Your custom package comes with a preinstalled voluntary ancillary benefits platform similar to what a Fortune 500 company offers their employees. Don't want to offer all of them? You can easily remove ancillary benefits at any time. You'll also have the ability to contribute funds to help your employees cover costs. It’s all up to you. Whatever works for your business, we'll make it easy. (Please note that availability of certain ancillary benefits will vary based on your SIC code.)

Coverage from leading benefits providers.

Complimentary industry-leading enrollment technology included.

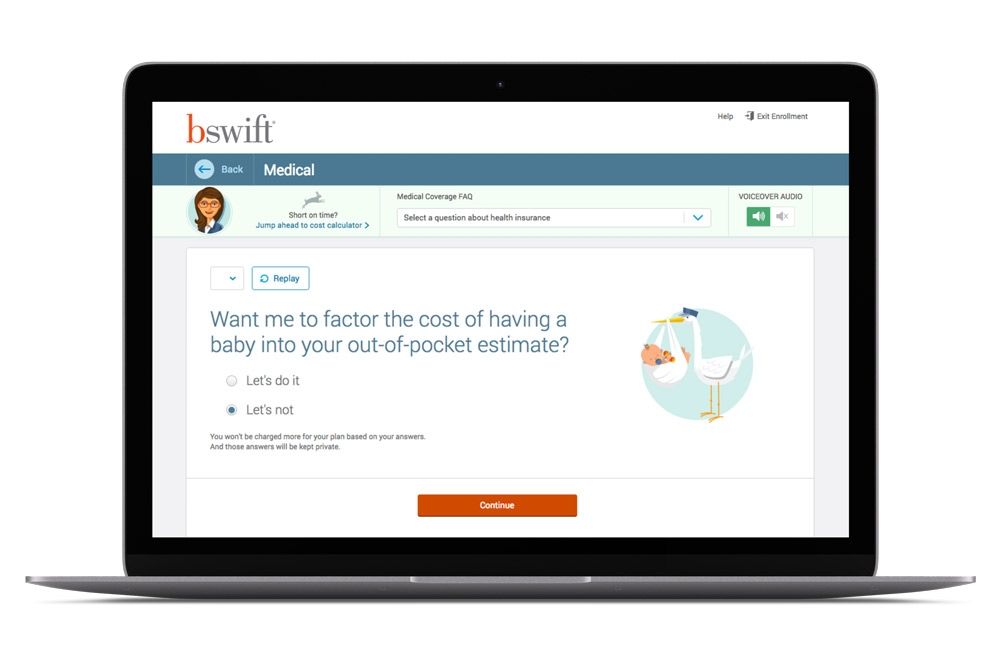

Our enrollment technology solutions are designed to make it easy for you to manage employee benefits — and make it simple for your employees to find the options they need.

A decision support tool is built right into your platform. By answering a few short questions, employees can find the plan that best suits their needs. Other support features include a filtering tool, plan comparisons, and provider search tools.

If an employee still has questions they can use the live chat or call to get the advice of one of our experienced benefits counselors.

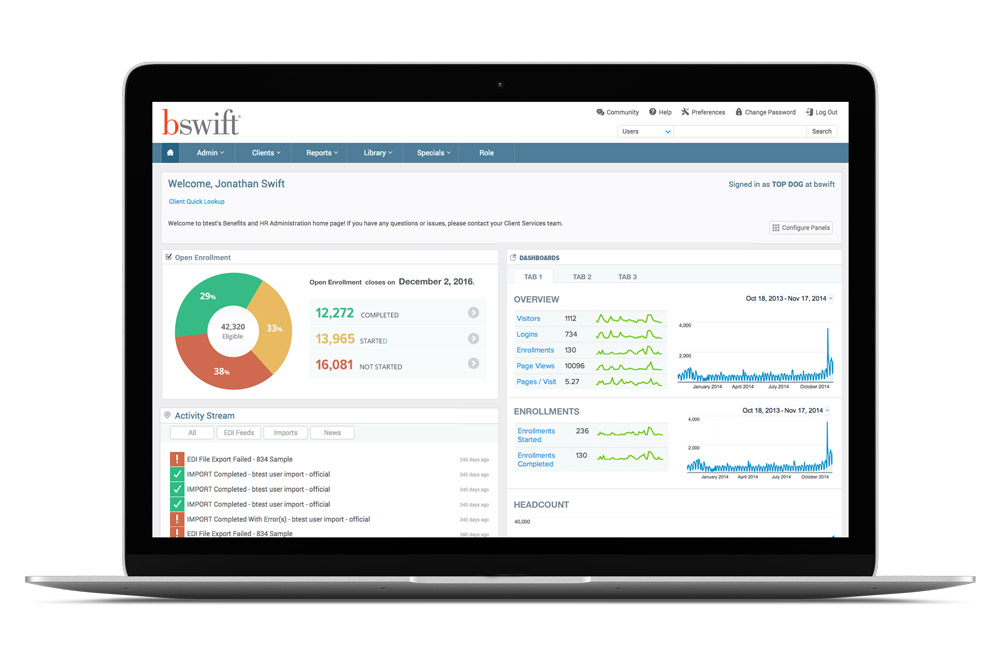

The HR Admin Portal is your source to manage your employees benefits. Once in the portal, you have access to real-time reporting tools that include almost any report you would ever need, and more!

Advanced billing features makes it easy for you to run monthly reports, apply retroactive adjustments, apply fees as appropriate, self bill, reconcile bills against carrier bills, and separate bills based on location, department, division or benefits status.

Make employees more aware of the investment you are dedicating to them with Total Compensation Statements. All enrollment information is already stored and the system can accept additional data such as payroll, 401(K) and more.

Special group rates for members, staff and dependents.

Choose from two MetLife PPO dental plans: one comes with the freedom to visit any licensed dentist, and the other allows you to save by visiting one of the thousands of participating dental locations nationwide, including specialists.1 Optional vision coverage can be added to either dental plan, and comes with coverage for exams, lenses, frames, contacts, and more.

Choose your plan and apply now.

• Lenses & frames

Helpful Dental Links

(coinsurance, copayments, deductibles, exclusions, and limitations)

(enter "PDP Plus" for network)

Helpful Vision Links

(coinsurance, copayments, deductibles, exclusions, and limitations)

(visit any provider, or save by using a participating MetLife provider)

1Savings from enrolling in the MetLife Dental Plan will depend on various factors, including how often participants visit the dentist and the costs for services rendered. Out-of-pocket costs may be greater if you visit a dentist who does not participate in the network.

2Rates are subject to geographic area and tier of coverage selected. Coverage may not be available in all states. Rates are subject to change.

This group plan is made available through the American Association of Business Networking (ABN). Membership in the ABN in required to enroll in this plan. You may enroll for membership in the ABN during your dental enrollment. Learn more about the ABN.

Group dental insurance policies featuring the Preferred Dentist Program are underwritten by Metropolitan Life Insurance Company, New York, NY 10166.

Vision plan may only be purchased in combination with a dental plan. Vision benefits are underwritten by Metropolitan Life Insurance Company, New York, NY (MetLife). Certain claim and network administration services are provided through Vision Service Plan (VSP), Rancho Cordova, CA. VSP is not affiliated with Metropolitan Life Insurance Company or its affiliates.

In some cases, the association and/or the plan administrator may incur costs in connection with providing oversight and administrative support for this sponsored plan. To provide and maintain this valuable membership benefit, MetLife reimburses the association and/or the plan administrator for these costs.

Like most group benefit programs, benefit programs offered by MetLife and its affiliates contain certain exclusions, exceptions, reductions, limitations, waiting periods and terms for keeping them in force. Please contact Member Benefits, the plan administrator at 1-800-282-8626 for costs and complete details.

Policy number 5343606

L0423031004[exp0425][All States][DC,GU,MP,PR,VI] © 2023 MetLife Services and Solutions, LLC

Group insurance coverage is issued by Metropolitan Life Insurance Company, New York, NY 10166.

Visiting a doctor just got a lot easier.

With an MDLIVE telehealth plan you can visit with a doctor 24/7 by phone, video, or app. It’s your anytime, anywhere doctor’s office. You'll have around-the-clock access to board-certified physicians and pediatricians—who can send prescriptions directly to your pharmacy, if medically necessary. Best of all: your family members can also use the service.

MDLIVE physicians treat more than 50 routine medical conditions, such as:

- Cold/Flu

- Allergies

- Cough

- Headache

- Sore throat

- Pink Eye

- Ear problems

- Nausea/Vomiting

- Sinus infection

- Acne

- Respiratory problems

- Urinary problems/UTI

Copyright © 2025 MDLIVE Inc. All Rights Reserved. MDLIVE is an independent company/entity and is not affiliated with Member Benefits. The services and website are provided exclusively by MDLIVE and not by Member Benefits. MDLIVE does not replace the primary care physician. MDLIVE operates subject to state regulation and may not be available in certain states. MDLIVE does not guarantee that a prescription will be written. MDLIVE does not prescribe DEA controlled substances, non-therapeutic drugs and certain other drugs which may be harmful because of their potential for abuse. MDLIVE physicians reserve the right to deny care for potential misuse of services. For complete terms of use visit www.mdlive.com/consumer/terms.html

The coverage you need. The answers you want.

Whether you’re turning 65, already on Medicare, or helping a family member with their decision, getting solid advice is vital. Is a Medicare Advantage Plan or a Medicare Supplement Plan right for you? What about prescription drug coverage? We can help you sort through the many confusing Medicare options to make the best decision for your specific circumstances.

Residents of FL / GA / TX:

Residents of all other states:

Please call 1-833-852-6353 to be connected with a HealthSherpa Medicare agent. (M-F, 9a-8p ET)

Have a question or need help enrolling?

Our licensed benefits counselors are here to help. Call us at 1-800-282-8626, or make an online appointment:

Copyright © 2025 Member Benefits Inc. All rights reserved. Terms of Use | Privacy Policy